Stripe bundle (PSP) - Business rules

All marketplaces types

Why

Stripe is a payment service provider. Its services allow users to pay on the platform and administrators to handle payouts.

Learn more about the PSP available in Second: Payment Service Provider Feature (PSP) - Business rules

Stripe is the default PSP enabled.

For which services

For all services

Interfaces

Please, find all interface documentation related to the Stripe bundle, here:

SBO:

Front:

Configurations

SBO > Other > Feature > Stripe

Workflows

Workflows of Stripe’s identity verification of users

Workflow of Stripe’s identity verification for users registered in France

Workflow of Stripe’s identity verification for users registered in the US

User registration and profile identity edition

User profile bank account edition

Listing deposit

Booking check

Booking confirmation

Booking cancellation

Booking acceptation

Booking validation

Booking bank wire check

Escrow management

Stripe Payment Methods

Direct Debit Payment

The direct debit payment option is available only when Stripe is selected as the payment service provider and when the booking start date is at least 14 days after the current date. Administrators need to manage this payment method through the SBO by modifying the "Payment Methods" Configuration.

For direct debit payments, the account holder's name, email address, and either the IBAN or bank account number are required.

When a customer selects Direct Debit as the payment method and click o "Pay", the booking request status is set to "Pending" until it is accepted by the vendor. Once the vendor accepts the request, the booking status temporarily changes to "Waiting for Payment". This brief period allows Stripe to process the payment transaction and send a confirmation to the platform. Upon receiving the confirmation, the status updates to "Paid". At this point, a mandate is issued, notifying the customer of the direct debit on their account.

If there are no issues with the payment transaction, the booking status will be updated to "Paid."

For direct debit payments, the payout may take up to 14 business days to become available. If the admin attempts to process the payment before this time, an error modal will be displayed.

Payment Error (Direct Debit)

If there is an error in the payment during a direct debit transaction, the booking status will be updated to "Status: Payment declined" when the vendor attempts to accept the booking.

In this scenario, the customer is required to create a new booking request.

Credit card payment

If the administrator activates credit card payments for Stripe on SCND, users will have the ability to complete bookings using a valid credit card. The credit card payment option will be presented after the checkout overview.

The user then enters his payment information (figure 11.2):

credit card number

expiration date

CVC

The credit card payment is done before the service is provided. However, the amount will not be debited until the offeror has accepted the booking request. The payment to the offeror is done once the service has been completed.

Once the credit card payment is successfully processed, the system redirects the user to the booking page, where the booking status is set to "Pending." Upon vendor approval, the status automatically updates to "Paid." If a payment error occurs, the booking request is not completed, and the customer must resubmit the booking request and payment.

Special rules

Stripe fees for admins

These fees are applied to all the payment transactions made on the platform.

For european cards: 1,4 % + 0,25 €

For non-european cards: 2,9 % + 0,25 €

Stripe KYC/KYB process

The validation process is partially managed by Stripe.

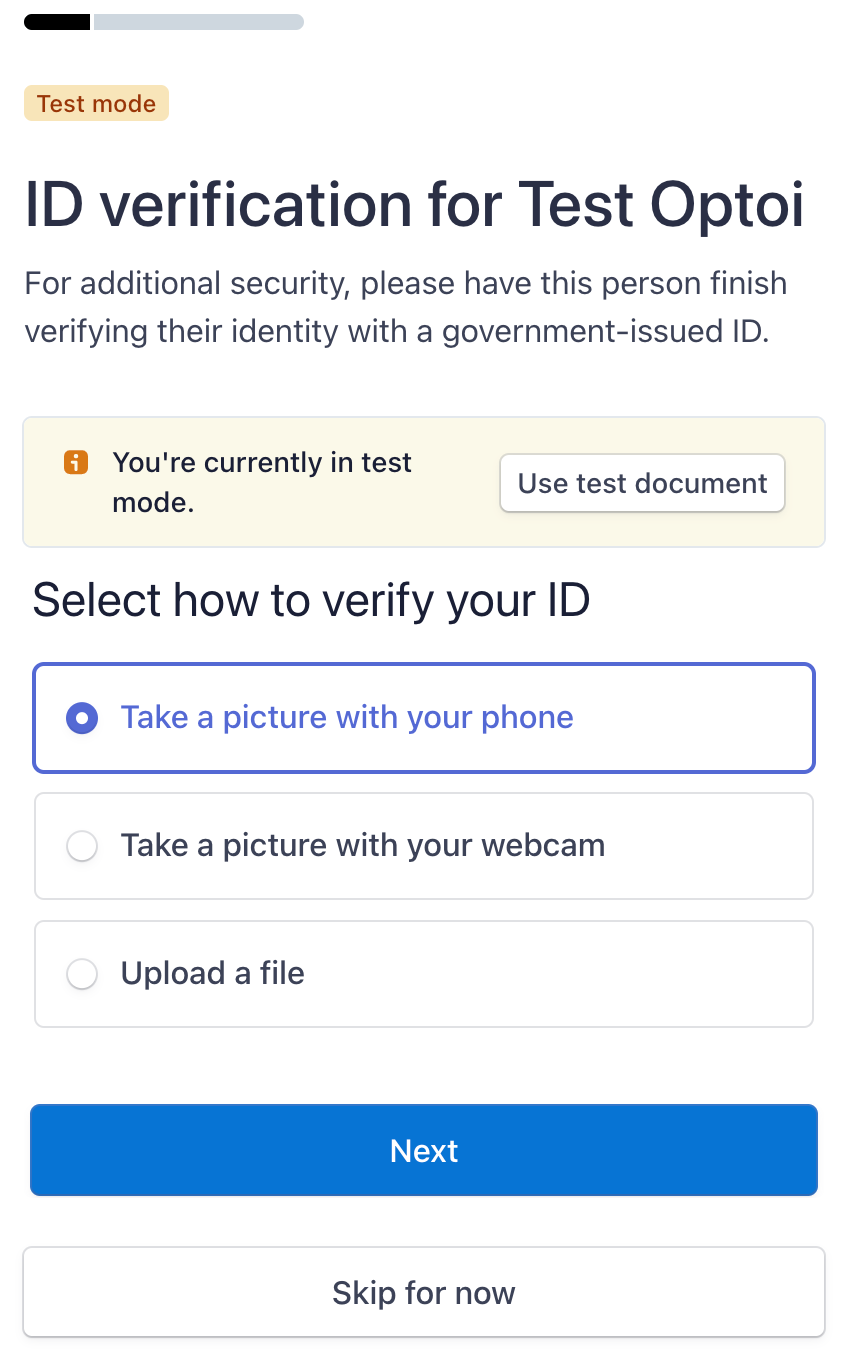

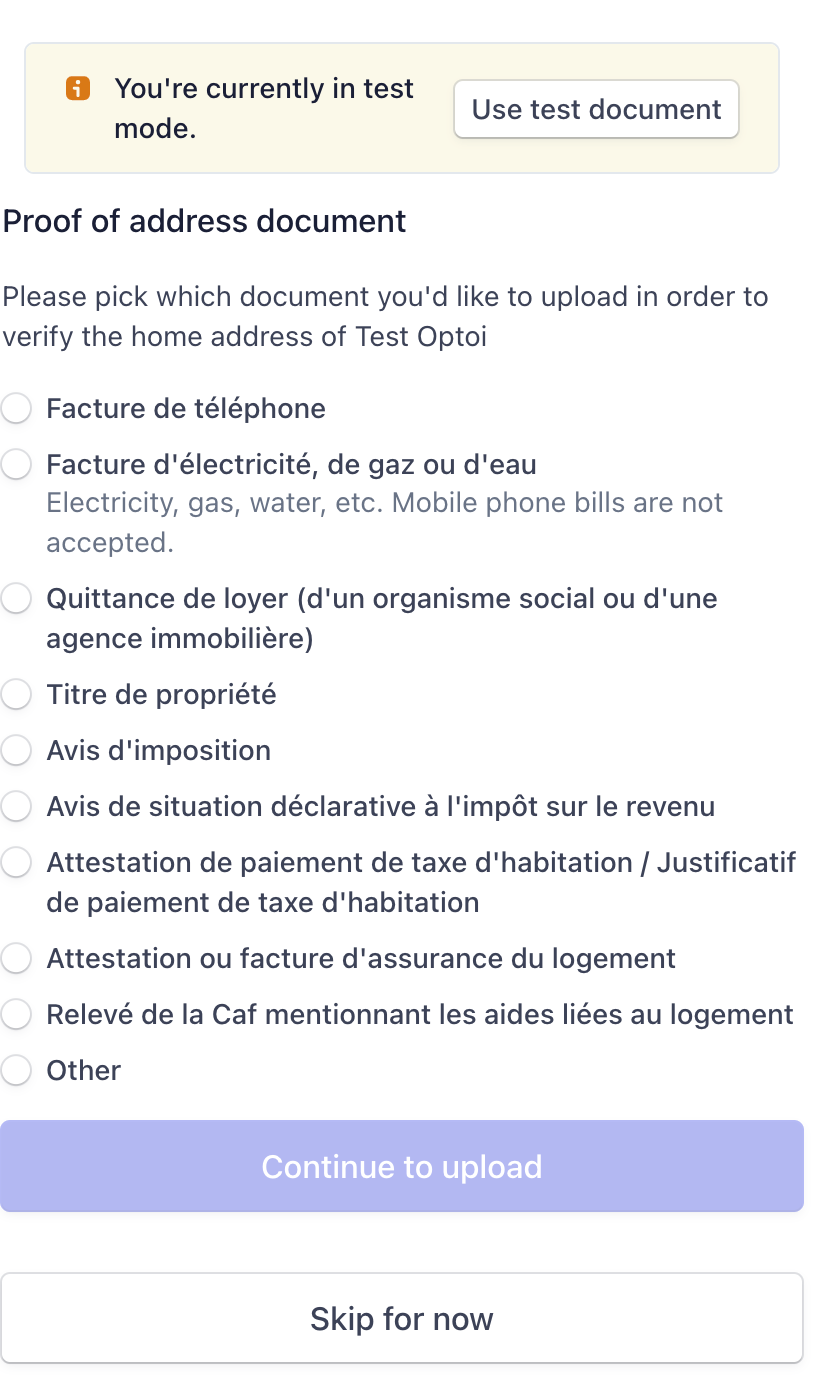

Once the user has filled in identity information: Identity , by clicking the button save, he will be redirected to a dedicated Stripe page that automatically manages the list of information that will be requested from the user.

The user will have:

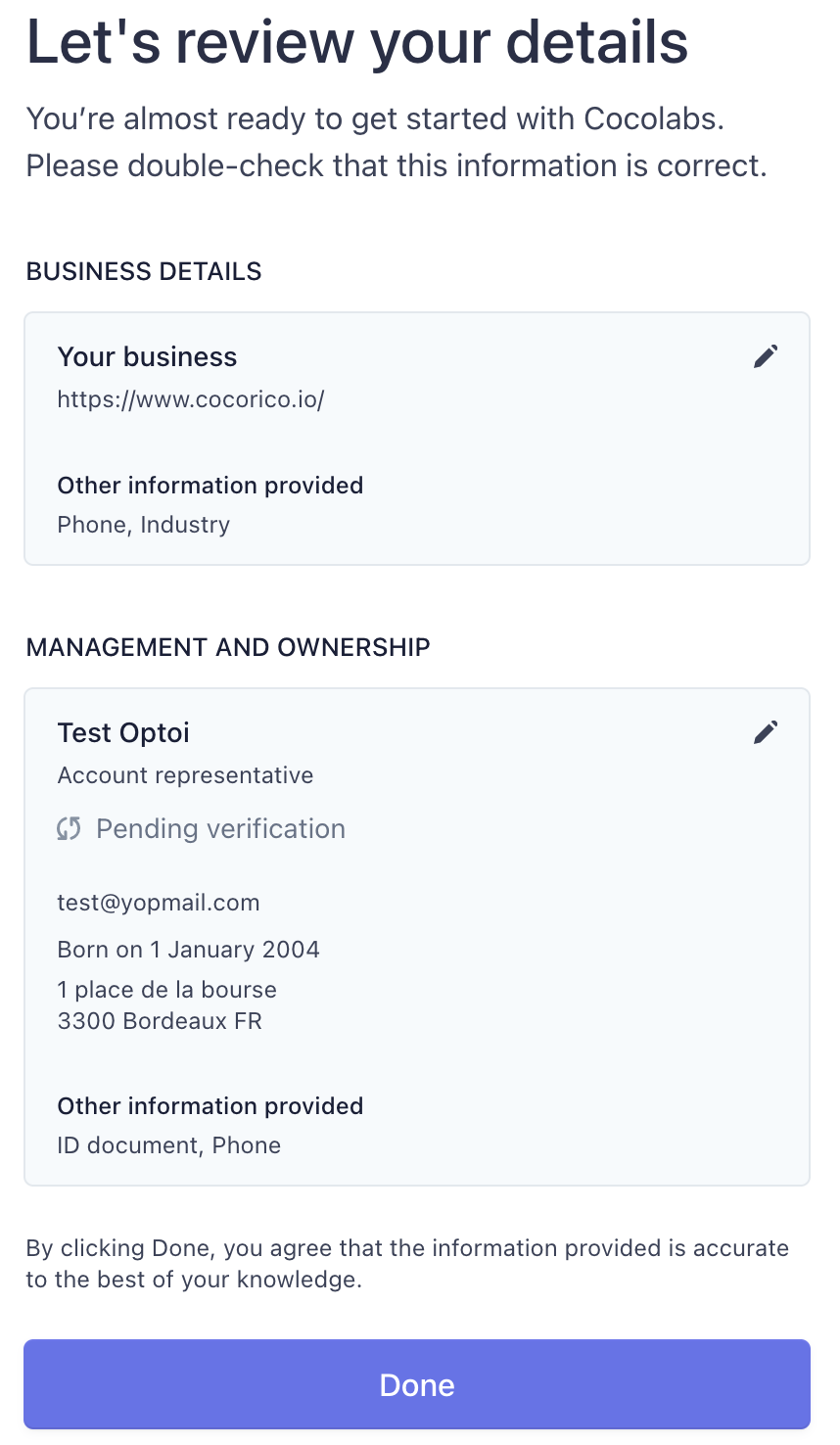

This screenshot has been taken in a test mode, the front can be changed a bit in production.

To verify his ID by taking a picture (figure 1)

Certify his address (figure 2)

Summary of his data (figure 3), once the user clicks the button “done”, he will be back on the platform.

Once the user is KYC/KYB validated he can no longer edit the following information:

First name

Last name

Birthdate

Escrow management

Stripe offers a workflow dedicated to the marketplace.

However, this workflow does not work for all countries that Stripe offers.

Second has integrated a workflow that allows the user to achieve the same result while working on all the countries that Stripe allows.

This workflow will revolve around the offeror's wallet, see: https://second-documentation.atlassian.net/wiki/spaces/SCNDFD/pages/6943049240#Escrow-management

During a pay-in, Stripe will transfer the total amount of the booking minus the fees to the wallet of the offeror.

Stripe collects these fees at that time and Stripe's fees just like other PSPs are based on the total amount of a pay-in.

This money will remain in escrow until the payout is made by the super administrator from the SBO.

Stripe will send the money to the offeror’s bank account and notify the platform in case of success or failure.

At the same time, the platform's fees will be available on the platform’s wallet.

Just like other PSPs, when a cancellation is made with a refund, it is automatic since the payment is by card.

Last updated

Was this helpful?